Important Tax Document Updates: 1099s

01/04/2023

Important Tax Document Updates: 1099s

Tax season can be confusing enough without having to worry about false tax documents showing up in your mailbox. With so many people moving to online sources of income, false or fake 1099s have become a common occurrence in recent years. Read on for more information on 1099s and how to assess them.

WHAT IS A 1099?

A 1099, specifically a 1099-K, reports tax information to you and the IRS about transactions from an app, online platform, or payment card processor. This covers a broad range of activities such as personal transactions, hobby income, or business income. Personal transactions include receiving money from family or friends via an app like Venmo or PayPal or receiving a reimbursement for personal expenses. You will also receive a 1099-K if you generate hobby income from selling items on Etsy or eBay. A 1099-K can even be produced if you sell tickets on Ticketmaster. Lastly, if you conduct business online such as through an app-based company like DoorDash, or receive real estate income from VRBO or Airbnb, you will receive a 1099-K.

There have been some big changes to 1099 reporting recently. The 2021 American Rescue Plan Act dropped filing requirements from any transaction over $20,000 to any transaction over $600. This tax year, many people will receive a 1099-K that previously have not before. It is important to be able to spot a legitimate 1099 from a potential scam.

CASE STUDY: EBAY 2021

Situation: In 2021, many people reported receiving a 1099-K that stated they had made income from selling on eBay. However, these people had never sold or listed anything on the site. While some reported making purchases on eBay, many did not even know how eBay had gotten their information. It is unclear whether some of these customers had registered as sellers, which would explain why eBay had personal information. With more than 50 complaints, eBay never made an official statement on the issue; their response to private inquiries was to throw away the erroneous 1099-K. They then closed the case as “resolved.”

Challenges: Tax experts do not recommend taking this course of action. It may seem that if a document was erroneously created it is useless, but it could also be a sign of identity theft. Even if you did not sell or list items on eBay, someone using your information may have. It is important to exhaust every avenue to find out why exactly you received a tax document. While it may end up being an accident, it can also be a sign of a larger problem.

Conclusion: From this situation, there are important tax practices that can be learned. The first is to be aware of what tax documents you should be expecting in the mail. The second is to never throw away something you believe could have been produced in error.

Actions: Follow the steps below for unexpected tax documents.

- Thoroughly check the document and mark all errors, if necessary.

- Contact the company to see if there was a clerical error or if their records indicate you owe money (or if someone who stole your information owes money).

- Check your bank and account statements for unauthorized uses.

- Look in your email for data breach notices.

- If you believe you are the victim of identity theft, visit identitytheft.gov for steps you can take.

- Report tax fraud to the IRS and/or fraud.org.

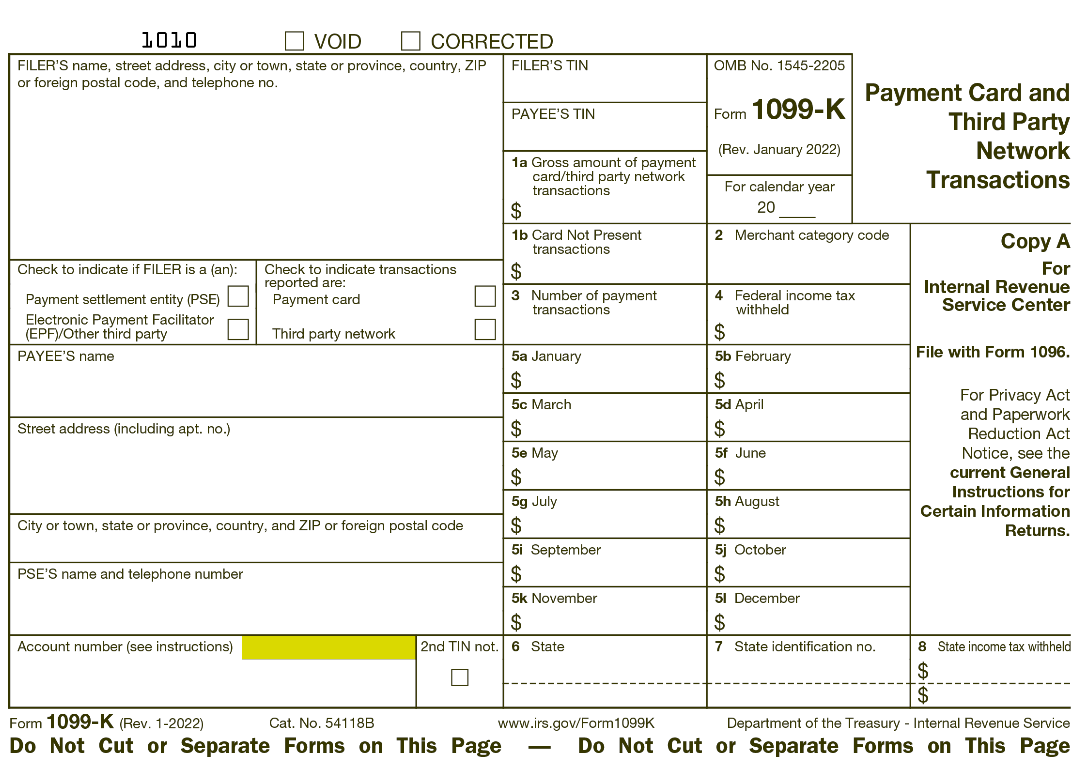

Below is a sample 1099-K. We recommend reviewing sample tax documents so that you can be prepared when real ones start coming in the mail. If you receive one, it is important to check your personal information as well as the information of the reporting company. Any discrepancies should be brought to the attention of the company, especially to avoid complications with the IRS. Tax season is hard enough, and while The Savings Bank can’t help you prepare your taxes, we can arm you with the knowledge to make it easier.

Sample 1099-K:

Sources:

Unexpected eBay 1099-K form could be fraud – Fraud

What is Form 1099-K? | H&R Block (hrblock.com)

https://www.irs.gov/businesses/understanding-your-form-1099-k

Solved: Received a 1099-k form yesterday from ebay, I have... - The eBay Community